1. Court’s decision

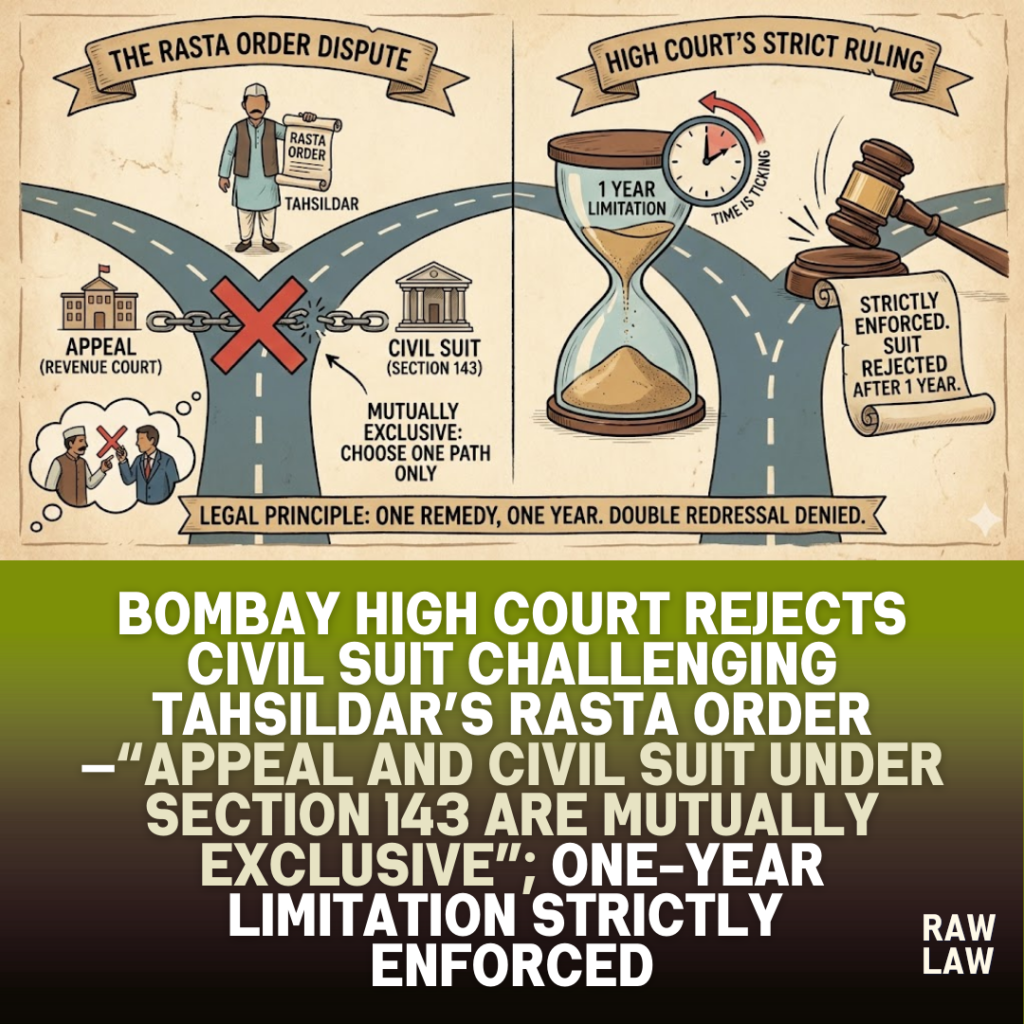

The Bombay High Court (Aurangabad Bench) allowed a Civil Revision Application and set aside the trial court’s order refusing to reject a plaint under Order VII Rule 11 CPC. The Court held that once the plaintiffs had chosen the statutory appeal remedy under Section 247 of the Maharashtra Land Revenue Code, 1966 against a Tahsildar’s order under Section 143, they could not subsequently institute a civil suit challenging the same order.

Further, the suit filed beyond one year from the Tahsildar’s decision was barred by limitation under Section 143(4) of the Code. The plaint in Regular Civil Suit No. 525 of 2024 was directed to stand rejected.

2. Facts

The dispute concerned an easementary right of way over agricultural lands situated at Kaudgaon Athre, Taluka Pathardi, District Ahmednagar. The applicant owned Gat No.106, while respondents owned Gat Nos.120, 121 and 122.

The applicant had initiated Rasta Case No.24 of 2020 under Section 143 of the Maharashtra Land Revenue Code. By order dated 15 February 2023, the Tahsildar allowed the application and declared that the applicant had an easementary access, which could not be obstructed.

Aggrieved, the respondents preferred RTS Appeal No.79 of 2023 before the Sub-Divisional Officer. The appeal remained pending and was ultimately withdrawn on 20 August 2024. Meanwhile, on 28 June 2024, the respondents instituted a civil suit seeking declaration that the Tahsildar’s order was illegal.

3. Issues

The High Court considered:

• Whether remedies under Section 143(3) (appeal/revision) and Section 143(4) (civil suit) are mutually exclusive.

• Whether a party who has preferred a statutory appeal can later institute a civil suit challenging the same Tahsildar decision.

• Whether the suit was barred by the one-year limitation prescribed under Section 143(4).

• Whether Section 14 of the Limitation Act could be invoked to exclude time spent in appeal.

4. Applicant’s arguments

The applicant contended that Section 143 provides alternative and inconsistent remedies. Once the respondents opted to file an appeal under Section 247, they were barred by the doctrine of election from filing a civil suit under Section 143(4).

It was further submitted that the suit was filed beyond one year from 15 February 2023 and was therefore clearly barred by limitation under the special statute.

Reliance was placed on precedents holding that special limitation prescribed under a local statute overrides the general provisions of the Limitation Act by virtue of Section 29(2).

5. Respondents’ arguments

The respondents argued that limitation should be governed by Articles 58 and 113 of the Limitation Act. They contended that limitation would commence from the appellate decision and that cause of action was recurring.

They further submitted that it was the litigant’s choice to either pursue appeal or file a civil suit. Time spent prosecuting the RTS appeal ought to be excluded under Section 14 of the Limitation Act.

They relied upon certain coordinate bench judgments to contend that the suit was maintainable.

6. Analysis of the law

The Court undertook a detailed reading of Section 143 of the Maharashtra Land Revenue Code. Sub-section (4) permits a civil suit within one year from the date of the Tahsildar’s decision. Sub-section (5) bars appeal or revision once a civil suit is instituted.

The Court interpreted this scheme as creating alternative and mutually exclusive remedies. The right to file a civil suit is confined strictly to challenging the Tahsildar’s decision and not the appellate authority’s order.

Once the appeal was filed, the Tahsildar’s order merged into the appellate proceedings. Even withdrawal of appeal could not revive the civil suit remedy.

7. Precedent analysis

The Court relied upon:

• State of Rajasthan v. Union of India (2018) 12 SCC 83, explaining the doctrine of election where two inconsistent remedies are available.

• Jagannath Ramu Mane v. Shree Ram Bharma Bandgar (Bombay High Court), holding remedies under Section 143 are mutually exclusive.

• Sanjay Kerba Kadam v. Manchak Kondiba Kadam, clarifying that once appeal is filed under Section 247, suit may not be maintainable.

• Prof. Sumer Chand v. Union of India (1994) 1 SCC 64, explaining Section 29(2) of the Limitation Act and primacy of special statutes.

The Court distinguished cases cited by respondents and noted that Section 29 of the Limitation Act had not been considered in earlier decisions relied upon by them.

8. Court’s reasoning

The Court held that Section 143 creates a self-contained mechanism. The phrase “decision of the Tahsildar” in sub-section (4) indicates that only the original order is open to civil challenge within one year.

Once the respondents invoked appellate jurisdiction, the doctrine of merger operated. The Tahsildar’s decision was no longer independently challengeable in a civil suit.

Further, limitation under Section 143(4) being part of a special statute overrides general limitation provisions. Sections 5 to 14 of the Limitation Act could not be invoked to extend or exclude time.

The suit filed on 28 June 2024, more than one year after 15 February 2023, was clearly time-barred. The trial court failed to consider Section 29 of the Limitation Act and the special limitation scheme.

9. Conclusion

The Civil Revision Application was allowed. The impugned order rejecting the application under Order VII Rule 11 was quashed. The plaint in Regular Civil Suit No.525 of 2024 was directed to stand rejected as barred by limitation and not maintainable.

10. Implications

This judgment reaffirms that:

• Remedies under Section 143 of the Maharashtra Land Revenue Code are alternative and mutually exclusive.

• Once a party elects the appellate remedy, civil suit remedy is barred.

• The one-year limitation under Section 143(4) is mandatory.

• Special statutory limitation overrides general limitation under Section 29(2) of the Limitation Act.

The ruling strengthens procedural discipline in land revenue disputes and curtails forum shopping between revenue and civil courts.

Case Law References

State of Rajasthan v. Union of India (2018) 12 SCC 83 – Doctrine of election; litigant cannot pursue inconsistent remedies.

Prof. Sumer Chand v. Union of India (1994) 1 SCC 64 – Special statute limitation prevails under Section 29(2) Limitation Act.

Jagannath Ramu Mane v. Shree Ram Bharma Bandgar (Bombay High Court) – Remedies under Section 143 MLRC are mutually exclusive.

Sanjay Kerba Kadam v. Manchak Kondiba Kadam (Bombay High Court) – Appeal under Section 247 bars subsequent suit.

FAQs

1. Can a party file both an appeal and a civil suit under Section 143 of the MLRC?

No. The remedies are mutually exclusive. Choosing one bars the other.

2. What is the limitation period for filing a civil suit against a Tahsildar’s Rasta order?

One year from the date of the Tahsildar’s decision under Section 143(4) of the Code.

3. Can time spent in appeal be excluded under Section 14 of the Limitation Act?

No. The special limitation prescribed under the Code prevails and Sections 5–14 of the Limitation Act cannot override it.